A drug formulary is a list of prescription medications that your health insurance plan agrees to cover. It’s not just a catalog-it’s a decision-making tool that determines which drugs you can get at a lower price, which ones require extra steps, and which ones might not be covered at all. If you’ve ever been surprised by a high pharmacy bill or told your doctor you can’t fill a prescription because it’s "not on the list," you’ve run into the real-world impact of a formulary.

How Formularies Work: The Basics

Every formulary is built by your insurance plan or a Pharmacy Benefit Manager (PBM) hired by them. These groups don’t just pick drugs randomly. They look at clinical evidence, safety records, and cost. The goal? To make sure you get effective medications while keeping overall healthcare spending under control. It’s not about limiting care-it’s about guiding care toward options that have proven results and better value. Formularies are updated regularly, sometimes even mid-year, based on new research, price changes, or the arrival of generic versions. That means a drug covered this year might not be next year. You can’t assume your medication will stay on the list just because it was covered last time.The Tier System: What You Pay Depends on the Tier

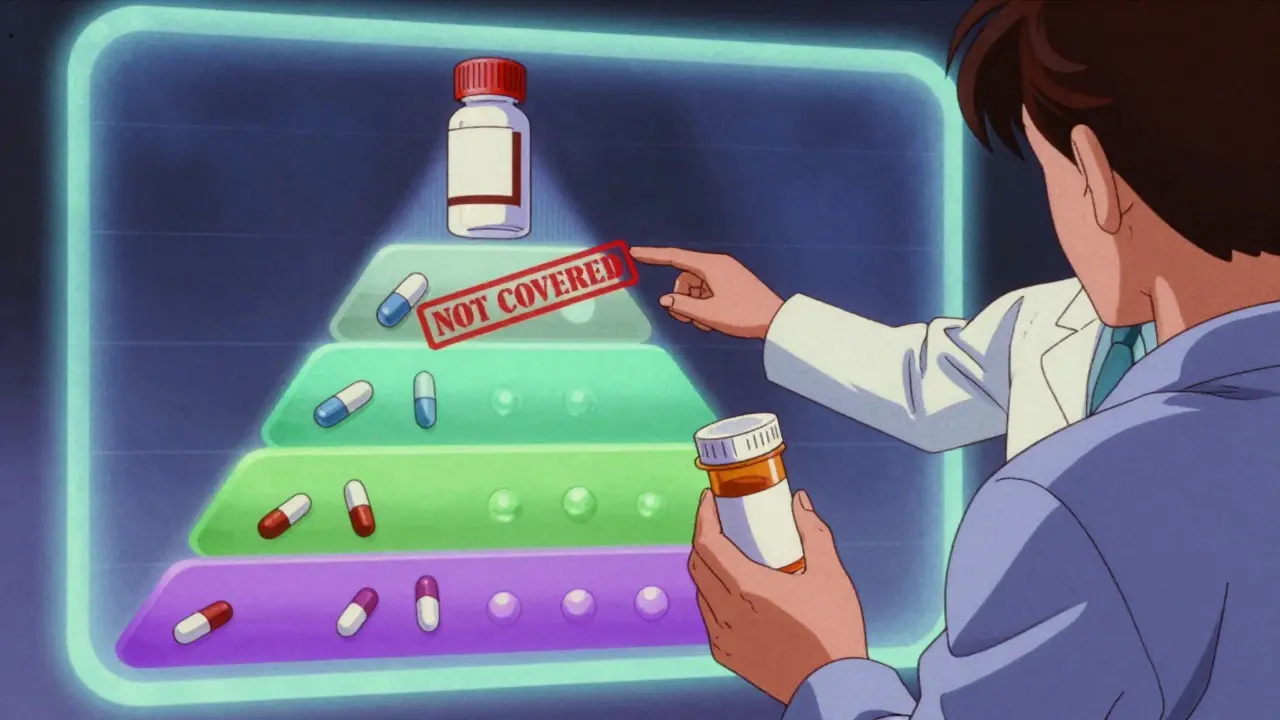

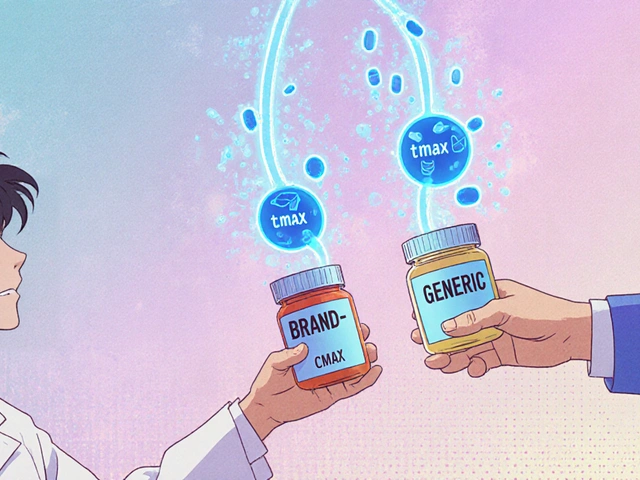

Most formularies use a tier system to show how much you’ll pay out of pocket. Think of it like a pricing ladder. The lower the tier, the less you pay.- Tier 1: Generic Drugs - These are copies of brand-name drugs that have lost patent protection. They’re required by the FDA to work exactly the same way. Most plans put these in Tier 1 because they cost very little. You might pay just $0-$10 for a 30-day supply.

- Tier 2: Preferred Brand-Name Drugs - These are brand-name medications that your plan has negotiated a good price on. They’re more expensive than generics but still considered cost-effective. Your copay could be $25-$50.

- Tier 3: Non-Preferred Brand-Name Drugs - These are brand-name drugs your plan doesn’t push as strongly. They’re more expensive, so your share goes up. Expect $50-$100 per prescription.

- Tier 4: Specialty Drugs - Used for serious conditions like cancer, MS, or rheumatoid arthritis. These drugs often cost thousands. Your share might be 30-50% of the price, or a $100+ copay.

- Tier 5 (if present): High-Cost Specialty Drugs - The most expensive medications, sometimes over $10,000 a month. These require special approval and often come with strict rules.

Here’s the key: the same drug can be on different tiers across different plans. A medication that’s Tier 2 on one plan might be Tier 3 on another. That’s why comparing formularies during open enrollment matters.

What Happens When Your Drug Isn’t on the List?

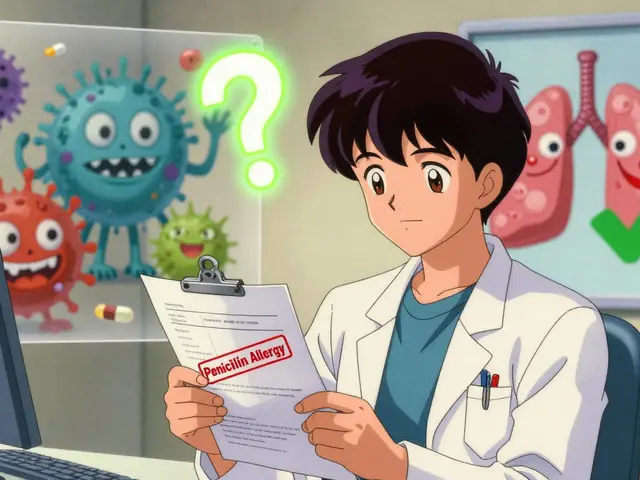

If your doctor prescribes a drug that’s not on your plan’s formulary, you’re looking at a big problem: either you pay full price or you don’t get it. That’s called a "non-formulary" drug. But there’s a way out: a formulary exception. You or your doctor can ask your insurance to cover the drug anyway. You’ll need to show why the alternatives on the formulary won’t work for you-maybe you had bad side effects, or it didn’t help before. The approval rate for these requests is around 67% for Medicare Part D plans. Expedited requests are available if your condition is urgent. In those cases, you can get a decision in as little as 24 hours. Don’t give up if your first request is denied. You can appeal.

Restrictions You Might Not Know About

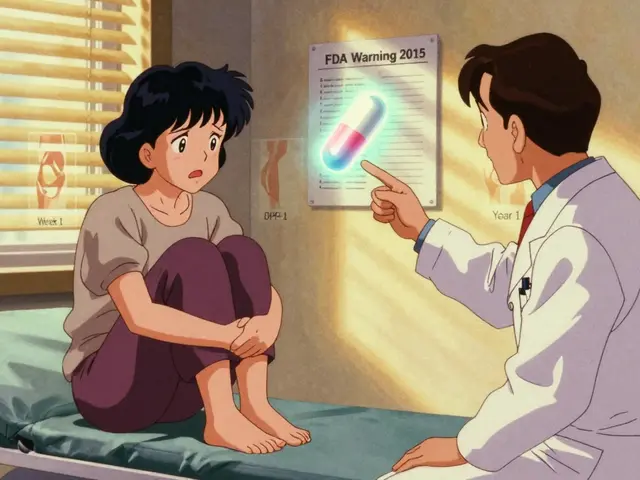

Even if a drug is on the formulary, your plan might still put rules on it:- Prior Authorization - Your doctor has to call or submit paperwork proving you need this specific drug before the plan will pay for it.

- Step Therapy - You have to try one or two cheaper drugs first. Only if they fail can you move to the one your doctor originally prescribed.

- Quantity Limits - You can only get a certain amount at a time. For example, your plan might limit you to a 30-day supply, even if your doctor wrote a 90-day prescription.

These rules aren’t meant to be annoying-they’re meant to prevent overuse and make sure you’re on the safest, most effective treatment. But they can delay care. Always ask your pharmacist or plan directly: "Does this drug need prior authorization?" before you leave the doctor’s office.

Why Formularies Change-and What It Means for You

Formularies aren’t set in stone. They’re reviewed every quarter by a team of doctors and pharmacists called a Pharmacy and Therapeutics (P&T) committee. They look at new studies, drug prices, and safety alerts. In 2023, a Kaiser Family Foundation study found that 42% of insured adults switched medications because their plan moved the drug to a higher tier or removed it entirely. One patient on Reddit said her diabetes drug jumped from $35 to $85 a month when it moved from Tier 2 to Tier 3. She had to switch. But it’s not all bad. Some patients benefit from changes. For example, when a new generic enters the market, it often replaces a costly brand-name drug on Tier 1. That means lower costs for everyone. The big takeaway? Check your formulary every year during open enrollment. Even if you’re happy with your plan, your medications might not be.How to Find Your Plan’s Formulary

You can’t guess what’s covered-you have to look it up. Here’s how:- Log in to your insurance website. Most plans have a "Drug List" or "Formulary" section under your benefits.

- Use the Medicare Plan Finder if you’re on Medicare Part D. It’s updated every October for the next year’s coverage.

- Call your plan’s customer service and ask for the current formulary document. They’re required to send it to you.

- Ask your pharmacist. They have access to real-time formulary data and can tell you if your drug is covered before you even get to the counter.

Don’t rely on what you remember from last year. In 2023, the Patient Advocate Foundation found that 28% of formulary changes happen outside the annual enrollment period. A drug can be removed or moved to a higher tier at any time-with just 60 days’ notice.

Real Stories: The Good, the Bad, and the Ugly

One patient on the Patient Advocate Foundation’s Facebook page shared: "I was terrified about my immunotherapy costs. But it was on Tier 4 with a $95 copay-instead of $5,000. It saved my life financially." Another user on Reddit wrote: "My heart medication was Tier 1 last year. This year, it’s Tier 3. My monthly cost went from $12 to $75. I had to switch. My new drug works fine, but I wish I’d known sooner." These stories aren’t rare. A 2024 GoodRx report showed that 73% of patients are satisfied when their meds are on low tiers. But 31% of people had a drug denied because it wasn’t on the formulary in the past year.What’s New in 2025

Starting in 2025, the Inflation Reduction Act caps out-of-pocket spending on all Medicare Part D drugs at $2,000 a year. That’s huge. It means even if your drug is on Tier 5, you won’t pay more than that annually. Also, new biosimilars-lower-cost copies of biologic drugs-are entering the market. By 2027, they could cut prices for drugs like Humira or Enbrel by 15-30%. These will likely be added to formularies as preferred options. AI is also starting to play a role. By 2027, some plans will use algorithms to recommend medications based on your history, genetics, and cost. It’s not science fiction-it’s coming.Your Action Plan: 5 Things to Do Today

1. Find your current formulary-go to your insurer’s website and download the latest list. 2. Check every medication you take-note the tier and any restrictions like prior authorization. 3. Ask your pharmacist-"Is this drug on my plan’s formulary? Any restrictions?" 4. Write down questions for your next doctor visit: "Is there a cheaper alternative on the formulary?" 5. Mark your calendar-October 15 to December 7 is Medicare’s open enrollment. Even if you’re not on Medicare, check your plan’s renewal window.Formularies aren’t perfect. They can be confusing, frustrating, and sometimes feel unfair. But they’re here to stay. Understanding them gives you power-not just to save money, but to make smarter choices about your health.

What is a drug formulary?

A drug formulary is a list of prescription medications that your health insurance plan covers. It’s organized into tiers that determine how much you pay out of pocket. The list is created by your insurer or a Pharmacy Benefit Manager (PBM) using clinical evidence and cost data to balance effectiveness with affordability.

Why is my medication not on the formulary?

A drug might be left off the formulary because it’s too expensive, there’s a cheaper alternative that works just as well, or it hasn’t been reviewed yet. Some newer or specialty drugs aren’t included until more data proves their value. If your drug isn’t listed, you can request a formulary exception through your doctor.

Can I still get a drug that’s not on the formulary?

Yes, but you’ll likely pay full price unless you get an exception. Your doctor can submit a request to your insurance plan explaining why you need the drug. If approved, the plan will cover it. Approval rates are about 67% for Medicare Part D plans. You can also appeal if your request is denied.

How often do formularies change?

Formularies are reviewed every quarter by a team of doctors and pharmacists. Changes can happen at any time, but most updates occur in January for the new year. Plans must give you 60 days’ notice if a drug is removed or moved to a higher tier. About 28% of changes happen outside the annual enrollment period.

What’s the difference between Tier 1 and Tier 2 drugs?

Tier 1 drugs are usually generics-the same as brand-name drugs but much cheaper. You pay $0-$10 per prescription. Tier 2 drugs are brand-name medications your plan has negotiated a good price on. You pay more-typically $25-$50 per prescription. The difference in cost can be hundreds of dollars a year.

Do all insurance plans have the same formulary?

No. Each plan creates its own formulary. A drug that’s on Tier 2 in one plan might be Tier 3 in another-or not covered at all. This is why comparing formularies during open enrollment is critical. Two people on different plans could pay completely different amounts for the same medication.

What should I do if my drug gets moved to a higher tier?

First, talk to your doctor. Ask if there’s a similar drug on a lower tier that would work for you. If not, ask for a formulary exception. You can also check if a generic version is available. If your costs jump too high and you can’t switch, you may qualify for financial assistance programs offered by drug manufacturers or nonprofits.

Just had to switch my blood pressure med last month because it got bumped to Tier 3. Went from $18 to $82 a month. My pharmacist saved me by pointing out a generic alternative that works just as well. Always ask them before you leave the doctor’s office - they know the real tea.

Also, formularies change so fast it’s ridiculous. I check mine every month now. No more surprises.

Ugh. This is why I hate American healthcare. You’re literally punished for being sick. My mom’s cancer drug got moved to Tier 5 and they didn’t even tell her until she got to the pharmacy. $1,200 out of pocket. She cried in the parking lot.

And now they want us to be grateful because there’s a ‘cap’ coming in 2025? Like, what were we supposed to do before that? Die? This system is designed to break people.

And don’t even get me started on PBMs - they’re the real villains here. No one even knows who they are but they control everything. It’s a scam.

Formularies are just corporate cost-shifting dressed up as ‘patient care’

Doctors don’t care. Pharmacies don’t care. You’re a number. Get used to it.

It’s worth noting that formulary tiers vary not just by insurer, but also by region and employer group. Even within the same national plan, two employees in different states may have completely different access to the same medication.

Always request the full formulary document in writing - verbal assurances from customer service are not binding. And yes, they are legally required to provide it within 10 business days.

My dad’s diabetes med got kicked off the list last year. We called his doctor, they filed an exception, and it got approved in 3 days. He’s fine now, but it was terrifying. Just don’t panic - there’s always a way. Talk to your pharmacist. They’re the unsung heroes of this whole mess.

Also, thank you for writing this. So many people have no idea how this works. You made it easy to understand.

The tier system is brilliant when you think about it - it’s behavioral economics applied to pharmacology. Lower tiers nudge people toward generics, which saves the system billions. The real tragedy isn’t the tiers - it’s that we let PBMs and insurers monopolize the process without transparency.

And yes, AI-driven formulary optimization is coming. It’ll be better. Less human bias. More data. But only if we demand accountability.

Also, biosimilars are the future. Humira’s gonna be a ghost by 2027. Mark my words.

I used to think formularies were just bureaucratic nonsense. Then my sister got diagnosed with MS and we had to navigate this mess. I learned that behind every tier and prior authorization is a real person trying to stay alive.

It’s not perfect, but understanding it helps you fight for what you need. I’m not angry at the system anymore - just determined to help others navigate it. Knowledge is power, even if the system doesn’t want you to have it.

It is imperative that all citizens of the United States of America, as stakeholders in the national healthcare infrastructure, engage in proactive formulary review during designated enrollment periods, as stipulated by the Centers for Medicare & Medicaid Services guidelines, in order to mitigate financial exposure and ensure continuity of therapeutic regimens. Failure to do so constitutes negligence of one’s fiduciary responsibility to self and family.

Furthermore, the proliferation of unregulated Pharmacy Benefit Managers represents a systemic erosion of democratic healthcare principles and must be addressed via federal legislative intervention.

My cousin in India gets insulin for $2. Here I pay $100. Why? I don't understand. This is not fair. My heart is sad.