Every year, the U.S. health system saves billions of dollars simply because generic drugs hit the market. It’s not magic. It’s math. When a brand-name drug loses its patent, generic versions enter the market, prices drop - often by more than 70% - and patients, insurers, and taxpayers all benefit. But how much do those savings actually add up to? And why do the numbers jump around so much from year to year?

What the FDA Tracks: Savings from New Generic Approvals

The FDA doesn’t just approve generic drugs - it measures the money saved the moment they hit shelves. Their method is simple: take the price of the brand-name drug before the generic arrived, compare it to the price after, multiply by how much was sold, and boom - you get the savings from that one approval.

This is where the big swings happen. In 2019, the FDA recorded $7.1 billion in savings from just the first generics approved that year. That was the highest in over a decade. Why? Because that year, several high-cost drugs - like the cholesterol medication Repatha and the diabetes drug Januvia - lost patent protection. Their generic versions slashed prices overnight.

But then came 2020. Savings dropped to just $1.1 billion. Not because fewer generics were approved. But because the drugs that lost patents that year weren’t blockbuster sellers. One generic might save $500 million. Another might save $10 million. It’s like winning the lottery - some years you hit the jackpot, other years you get a dollar.

By 2022, savings jumped again to $5.2 billion. The FDA pointed to a few approvals in large markets - drugs used by hundreds of thousands of patients - as the reason. That year, 742 generic applications were fully approved, and nearly $1.7 billion of those savings came from just five drugs. One of them? A generic version of the asthma inhaler Advair. Before generics, it cost over $300 per prescription. After? Under $50.

Total Savings: What the Industry Measures

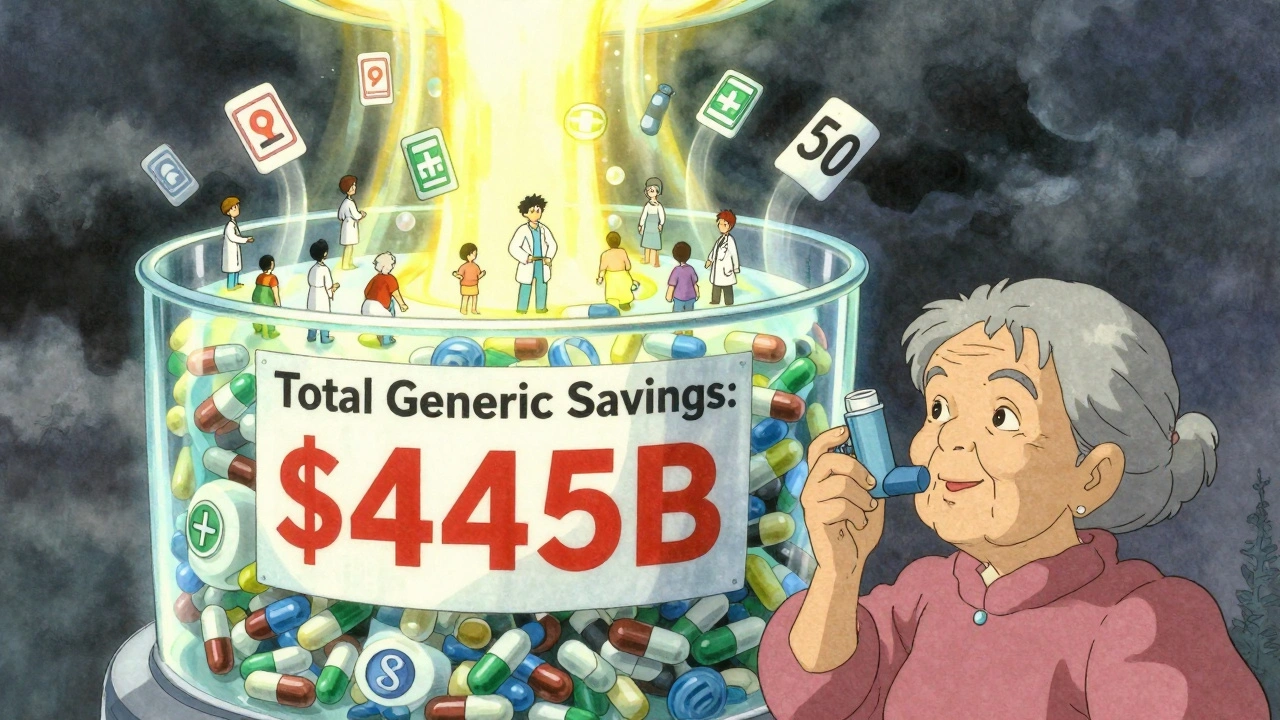

While the FDA looks at the impact of new entries, the Association for Accessible Medicines (AAM) takes a broader view. They count every single generic drug sold in a year - not just the new ones - and compare what was actually spent versus what would’ve been spent if all those drugs were still brand-name.

In 2023, that number hit $445 billion. That’s not a typo. That’s nearly half a trillion dollars saved in one year. To put that in perspective: Americans filled over 4 billion prescriptions in 2023. Ninety percent of them were generics. Yet those generics made up only 13% of total drug spending.

Who benefited most? Medicare saved $137 billion. Commercial insurers saved $206 billion. Medicaid saved the rest. That’s $2,672 saved per Medicare beneficiary - enough to cover a year’s worth of insulin, blood pressure meds, or antidepressants without a copay.

Some states saw massive savings. California’s Medicaid program saved $38 billion. Alaska saved $354 million. The scale depends on population, prescription volume, and how many high-cost drugs went generic in that state. But no matter where you live, generics lowered your pharmacy bill.

Why the Numbers Don’t Always Match

It’s easy to get confused. One report says $5 billion. Another says $445 billion. Which one’s right? Both. They’re just measuring different things.

The FDA’s number - say, $5.2 billion in 2022 - is the savings from drugs approved that year, tracked for 12 months after approval. It’s the immediate shockwave when a new generic enters the market.

The AAM’s number - $445 billion - is the total savings from every generic drug sold that year, regardless of when it was approved. It’s the cumulative effect of decades of generic competition.

Think of it like a river. The FDA measures the rainfall that fell last month. The AAM measures how much water is flowing down the river right now. One tells you about new storms. The other tells you how full the reservoir is.

Who’s Really Saving Money?

It’s not just insurers. It’s you.

The average generic copay in 2019 was $6.97. Most generics cost under $20. For chronic conditions - diabetes, high blood pressure, asthma - that’s the difference between filling your prescription every month or skipping doses because you can’t afford it.

But here’s the catch: not all savings reach the patient. Pharmacy benefit managers (PBMs) negotiate rebates with drugmakers. Some of that money goes back to insurers, some to PBMs, and sometimes very little ends up lowering your out-of-pocket cost. A 2023 Senate investigation found only 50-70% of generic savings actually flow to consumers.

Still, the impact is real. Patients with heart disease saved $118 billion in 2023. Those with mental health conditions saved $76 billion. Cancer patients saved $25 billion. These aren’t abstract numbers. They’re people choosing to take their meds because they can afford them.

What’s Next for Generic Savings?

The pipeline is full. Dozens of blockbuster drugs are set to lose patent protection over the next five years. The diabetes drug Ozempic, the migraine drug Aimovig, and the cancer drug Keytruda are all on the horizon. When generics arrive, savings could spike again.

But it’s getting harder. Some drugs are complex - biologics, inhalers, injectables - and making exact generic copies (called biosimilars) takes more time and money. As of August 2024, the FDA had approved 59 biosimilars. That’s progress, but it’s still a tiny fraction of the 742 small-molecule generics approved in 2022.

Brand drugmakers are also finding new ways to delay generics - through patent tricks, regulatory delays, and complex risk programs. The FDA’s 2023 Drug Competition Action Plan is trying to crack down on these tactics. Faster approvals mean sooner savings.

By 2033, U.S. generic drug sales are projected to hit $131.8 billion. That’s up from $95.87 billion in 2024. The aging population, rising drug prices, and pressure on public payers will keep pushing demand for cheaper alternatives.

Why This Matters Beyond the Numbers

Generic drugs aren’t just cheaper. They’re essential. Without them, the U.S. health system would be unaffordable. One in five Americans skips meds because of cost. Generics cut that risk dramatically.

They also free up money for other care. Medicaid programs that save billions on pills can spend more on mental health services, home care, or preventive screenings. Hospitals that pay less for drugs can hire more nurses or upgrade equipment.

And for patients? It’s not just about saving money. It’s about dignity. It’s about being able to manage your diabetes, take your blood pressure pills, or keep your asthma under control - without choosing between medicine and groceries.

The FDA’s year-by-year breakdowns show us the volatility of this system. But the AAM’s long-term totals show us the truth: generics are the backbone of affordable health care in America. And as long as patents expire and competition kicks in, those savings will keep growing.

How much money do generic drugs save the U.S. each year?

In 2023, generic and biosimilar drugs saved the U.S. health system $445 billion, according to the Association for Accessible Medicines. This includes savings across Medicare, Medicaid, and private insurers. The FDA reports additional savings from new generic approvals - for example, $5.2 billion in 2022 from drugs approved that year - but these are separate from the total annual savings from all generics in use.

Why do generic drug savings vary so much from year to year?

Savings jump or drop based on which brand-name drugs lose patent protection. If a high-cost drug like a cancer therapy or heart medication goes generic, savings can hit billions. But if only low-cost or low-volume drugs go generic, savings stay small. That’s why 2019 had $7.1 billion in savings from new approvals, while 2020 dropped to $1.1 billion - it depended entirely on the drugs involved.

Do patients actually see lower out-of-pocket costs with generics?

Often, yes. The average generic copay is under $7, and 92% of generic prescriptions cost $20 or less. But not all savings reach patients. Pharmacy benefit managers (PBMs) sometimes keep rebates instead of lowering copays. Studies show only 50-70% of generic savings are passed directly to consumers, meaning some patients still pay more than they should.

What’s the difference between FDA and AAM savings numbers?

The FDA measures savings from drugs approved in a given year during their first 12 months on the market. The AAM measures total savings from every generic drug sold in a calendar year, no matter when it was approved. The FDA number is about new competition; the AAM number is about the full impact of generics in the system.

Are biosimilars saving as much as traditional generics?

Not yet. Biosimilars - generic versions of complex biologic drugs - are harder and more expensive to make. As of 2024, the FDA had approved 59 biosimilars, but their total savings are still small compared to traditional generics. Most savings today come from small-molecule generics like metformin or lisinopril. However, as more biologics lose patents, biosimilar savings are expected to grow significantly in the next decade.

So let me get this straight - we’re saving $445 billion a year on pills, but my insulin still costs $300? 😒 Guess the ‘savings’ are just fancy numbers on a PowerPoint slide while I’m choosing between meds and rent. Thanks, capitalism.

Bro this is why India is the pharmacy of the world 🇮🇳😂 You think the FDA is doing magic? Nah. It's Indian generic manufacturers like Dr. Reddy’s and Cipla who make these drugs for pennies and export them. In Mumbai, you can buy metformin for 2 rupees a pill - that’s like 2 cents. The US system is broken because they let PBMs and pharma CEOs suck the blood out of patients. I work in pharma logistics - I’ve seen the factories. The cost to produce a 30-day supply of lisinopril? Less than $0.50. They charge $15 because they can. Sad.

Wow. A whole article about how cheap pills save money. Groundbreaking. Next you’ll tell me water is wet. Why is this even a thing? Everyone knows generics are cheaper. The real story is how the FDA and AAM are both just PR arms for Big Pharma. They love talking about ‘savings’ so we forget they’re still overcharging us.

It’s funny how we treat medicine like a commodity when it’s the only thing standing between life and death for millions

Generics aren’t just about dollars they’re about dignity

When you can afford to take your pills you stop being a patient and start being a person

But the system still treats you like a balance sheet

And that’s the real tragedy here not the numbers

It’s that we’ve normalized choosing between breathing and eating

It’s critical to distinguish between ‘new approval savings’ (FDA) and ‘cumulative generic utilization savings’ (AAM) - they’re not competing metrics, they’re complementary. The FDA’s $5.2B in 2022 reflects the marginal impact of new entrants disrupting price floors, while AAM’s $445B captures the systemic effect of decades of generic penetration. The 90% prescription volume stat is key - generics dominate access, not just cost. The real bottleneck now is biosimilar uptake due to manufacturing complexity and patent evergreening by originators. We need policy interventions like FDA’s Drug Competition Action Plan to accelerate biosimilar approvals, especially for biologics like Humira and Enbrel where biosimilar competition has been glacial.

America saves half a trillion on pills and still cries about healthcare costs? LOL

Generic drugs = American ingenuity

Other countries? They’re still paying brand prices

We win

End of story

Just read this and thought of my mom who takes 6 meds a day and still pays $15 for each because her plan says so

She doesn’t know about PBMs or savings stats

All she knows is that her pills are cheaper than they were 5 years ago

And that’s enough

Thanks to the people who make these generics

And the FDA for letting them in

Not perfect but way better than before

Why are we even talking about this? Everyone knows the system is rigged. PBMs, patents, loopholes - it’s all a scam. And the FDA? They’re just the bouncer letting the rich party in. 💀