The U.S. Food and Drug Administration (FDA) doesn't treat biosimilars like generic pills. You can't just reverse-engineer a biologic drug the way you would a chemical tablet. Biologics are made from living cells - proteins, antibodies, complex molecules that behave differently in the body than simple chemicals. That’s why a biosimilar isn’t a copy. It’s a highly similar version, built to match the original in safety, purity, and potency. And as of October 2025, the FDA changed how it reviews them - making it faster, cheaper, and more science-driven than ever before.

Why Biosimilars Aren’t Generics

Generics are exact chemical copies of brand-name drugs. Take aspirin or metformin: their molecules are small, stable, and easy to reproduce. A generic pill has the same atoms in the same order. No guesswork. Biosimilars? They’re different. Think of them like a handmade replica of a Picasso painting. You can match the brushstrokes, colors, and composition, but you can’t recreate the exact same brush used by the artist. Biologics are made in living systems - cells grown in bioreactors. Tiny changes in temperature, nutrients, or cell lines affect the final product. Even minor differences can change how the drug works in the body.That’s why the FDA requires far more than just chemical testing. Before 2025, getting a biosimilar approved meant running full-scale clinical trials comparing it directly to the original biologic - often taking 3 years and costing over $200 million. The goal was to prove it worked just as well. But with new analytical tools, the FDA now says: we don’t always need to test it on thousands of patients.

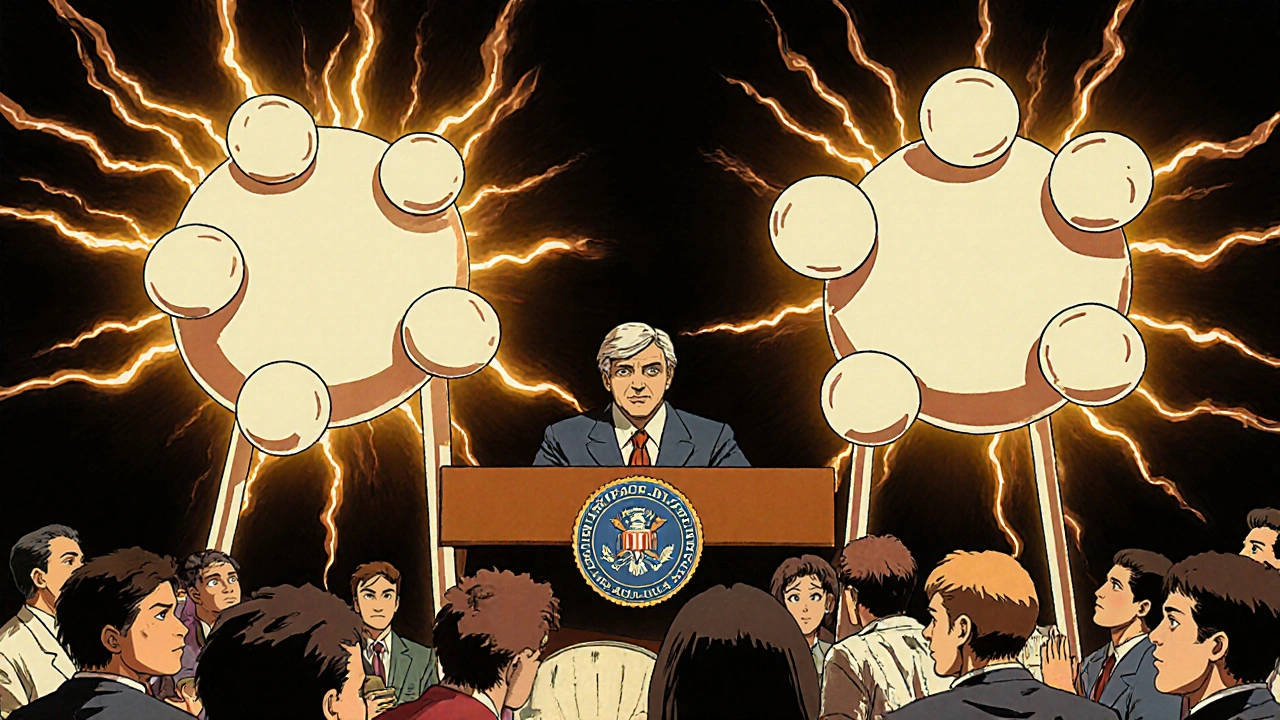

The 2025 FDA Guidance: What Changed

On October 29, 2025, the FDA released a draft guidance that overhauled its biosimilar review process. This wasn’t a minor tweak. It was the biggest update since the Biologics Price Competition and Innovation Act (BPCIA) passed in 2010. The key shift? Comparative efficacy studies are no longer routinely required.Instead, the FDA now says: if you can show deep analytical similarity - using modern techniques like mass spectrometry, chromatography, and advanced bioassays - and prove your biosimilar behaves the same way in the body through pharmacokinetic (PK) and immunogenicity studies, that’s often enough. You don’t need to run a multi-year trial showing it treats rheumatoid arthritis or breast cancer just as well as the original.

The guidance sets three clear conditions where this streamlined path works:

- The reference biologic and the biosimilar are made from the same type of clonal cell line and are highly purified.

- The link between the molecule’s structure and its clinical effect is well understood (like with adalimumab or trastuzumab).

- A human PK study - showing how fast the drug enters and leaves the bloodstream - is feasible and meaningful.

For complex molecules like antibody-drug conjugates, where the structure-function relationship isn’t fully mapped, the FDA still recommends full clinical studies. But for most monoclonal antibodies - the most common type of biologic - this new path cuts development time from 8-10 years to 5-7 years and reduces costs from $100-300 million to $50-150 million.

Interchangeability: The Big Controversy

One of the biggest debates in biosimilars is interchangeability. That’s when a pharmacist can swap a biosimilar for the brand-name drug without asking the doctor. In the U.S., this has been a major barrier. The FDA used to require switching studies - testing whether patients do fine when they alternate between the original and biosimilar over time. That added more cost and delay.In October 2025, FDA Commissioner Marty Makary made a bold statement at the GRx+Biosims conference: “Every biosimilar should have the designation of interchangeable.” He called interchangeability “a legislative term, not a scientific term.”

That sparked controversy. Critics argue that removing the extra hurdle could confuse doctors and patients. Dr. Robert Popovian from PhRMA warned it might undermine trust. But the FDA has already acted: two denosumab biosimilars - Enoby and Xtrenbo - received interchangeability designations in October 2025, the first time multiple interchangeable biosimilars were approved for the same reference product.

Here’s the catch: federal law still requires a separate application for interchangeability. The FDA can’t just declare all biosimilars interchangeable by fiat. That’s a job for Congress. Until then, the agency continues to approve interchangeability on a case-by-case basis - but with much lower barriers.

How the FDA Actually Reviews a Biosimilar

The process starts with a Biologics License Application (BLA) under Section 351(k) of the Public Health Service Act. The FDA doesn’t just look at one piece of data. It demands a full picture:- Analytical studies: Over 200 quality attributes are measured - protein structure, sugar chains, impurities, stability. Techniques like liquid chromatography and high-resolution mass spectrometry compare the biosimilar to the original at a molecular level.

- Nonclinical studies: Toxicity tests in animals, if needed. Often skipped if analytical data is strong.

- Pharmacokinetic (PK) studies: Shows how the body absorbs, distributes, and clears the drug. Must match the reference product within strict limits.

- Immunogenicity assessment: Does the biosimilar cause more or different immune reactions? Even small differences here can lead to side effects or reduced effectiveness.

- Clinical studies: Now only required if the above data isn’t sufficient. Often just one study, focused on PK or safety in a sensitive population.

After submission, the FDA has 30 days to review the application for completeness. If accepted, the clock starts on the review timeline. Under BsUFA III (Biosimilars User Fee Amendments), the FDA aims to complete reviews in 10 months for standard applications and 8 months for priority ones.

Who’s Winning and Who’s Struggling

As of late 2025, the FDA has approved 76 biosimilars. But only 28 companies have brought any to market. Most are big players: Sandoz (17 approved), Pfizer (12), Amgen (10). Smaller biotechs? Only 12 biosimilars came from companies with fewer than 100 employees. Why? The analytical tools needed - mass spectrometers, automated bioassay platforms - cost millions. Setting up a quality control system takes 12-18 months. That’s a wall for startups.Still, the tide is turning. Emerging players like Viatris and Biocon are gaining ground. And the FDA’s new guidance is helping. The Biosimilars Council reports 87 technical consultations were provided to small developers in 2025 alone. The FDA’s Biosimilars Community Resource Center had over 12,700 visitors in October 2025.

Market share is still low in the U.S. - just 23% for products with biosimilar options. Compare that to Europe, where biosimilars hold 67% of the market. Why? In the U.S., physician hesitation, payer restrictions, and patent lawsuits have slowed adoption. The FTC found that 68% of approved biosimilars have been delayed by patent litigation.

Real-World Impact: Hospitals, Patients, Costs

The savings are real. A single biologic like adalimumab (Humira) can cost $50,000-$100,000 per patient per year. Biosimilars typically launch at 15-35% lower prices. Mayo Clinic reported a 37% drop in biologic spending after switching to biosimilars for cancer treatments - saving $18 million annually.Patients are noticing too. A September 2025 Arthritis Foundation survey of 1,247 users showed 78% were satisfied with biosimilar effectiveness. But 41% had initial safety concerns. After talking to their doctors, 68% of those worries disappeared.

On Reddit’s r/pharmacy community, a November 2025 thread on switching to a biosimilar for rheumatoid arthritis had 87 responses. Sixty-three percent said their symptoms stayed the same. Twenty-two percent reported minor differences - mostly injection site reactions. No major safety issues.

But here’s the problem: state laws. Thirty-four states still require special rules before a pharmacist can substitute a biosimilar. Even if the FDA says it’s interchangeable, a pharmacist in Texas or Florida might still need a doctor’s OK. That creates confusion and delays.

What’s Next

The FDA’s draft guidance is open for public comment until January 27, 2026. Final rules are expected by June 2026. Industry analysts predict biosimilar approvals could jump from 8-10 per year to 15-20. By 2030, McKinsey forecasts biosimilars could capture 40-50% of the market - up from 23% - saving the U.S. healthcare system $150 billion annually.But challenges remain. Patent thickets still block entry. Physician education is lagging. And the interchangeability debate isn’t over. Until Congress clarifies the law, the FDA walks a tightrope - pushing science forward while respecting legal boundaries.

The message is clear: biosimilars are here to stay. The FDA’s 2025 update removes the biggest roadblocks. The next step? Making sure patients, doctors, and pharmacists know how to use them - and that the savings actually reach the people who need them most.

Are biosimilars the same as generics?

No. Generics are chemically identical copies of small-molecule drugs. Biosimilars are highly similar but not identical copies of complex biologic drugs made from living cells. They require more testing because their structure and function are harder to replicate exactly.

How long does it take to get a biosimilar approved by the FDA now?

Before 2025, it often took 8-10 years. With the new guidance, development time is now estimated at 5-7 years. The FDA’s review clock starts after a complete application is submitted and typically takes 8-10 months, depending on priority status.

Do I need a new prescription to get a biosimilar?

If the biosimilar has interchangeability status, a pharmacist can substitute it without a new prescription - just like with generics. If it’s not interchangeable, your doctor must specifically prescribe the biosimilar. State laws vary, so check local rules.

Why aren’t more biosimilars on the market in the U.S.?

High development costs, patent lawsuits delaying entry, physician hesitation, and confusing state substitution laws have slowed adoption. Even though 76 biosimilars are approved, only 28 companies have brought them to market, and U.S. market share remains at 23% compared to 67% in Europe.

Can biosimilars cause more side effects than the original biologic?

FDA data shows biosimilars have similar safety profiles to their reference products. Minor differences, like more injection site reactions, have been reported in some cases, but no widespread increase in serious side effects. Large-scale studies and post-market monitoring continue to track safety.

What therapeutic areas have the most biosimilars?

Oncology leads with 31% market share for biosimilars, followed by autoimmune diseases like rheumatoid arthritis and Crohn’s disease (18%). Diabetes and osteoporosis are growing areas. Biosimilars for complex drugs like antibody-drug conjugates are still rare due to technical challenges.

The FDA's 2025 guidance is pure regulatory arbitrage. Analytical similarity ≠ clinical equivalence. You're trading patient safety for speed. Mass spec can't capture post-translational heterogeneity in real-time biological systems. This isn't innovation-it's cost-cutting dressed as science.

Oh please. You think this is about science? It's about profit. Big Pharma doesn't want competition-they want monopolies. The FDA? They're just the lapdog. You think they care if your insulin works? No. They care if the stock price goes up. Biosimilars are a threat to the entire broken system. And now they're making it easier to sneak in subpar drugs under the guise of 'efficiency.' Wake up.

They'll say 'it's similar'-but similar doesn't mean safe. Not when you're injecting living proteins into humans. You don't know what the cell line did last Tuesday. You don't know what impurities are lurking. You're gambling with autoimmune diseases, cancer, diabetes. And for what? A 15% discount?

Meanwhile, in Europe, they've got 67% adoption. Why? Because they trust the science. Here? We trust spreadsheets. The FDA used to be a shield. Now it's a velvet hammer. And we're the ones getting crushed.

And don't even get me started on interchangeability. Let pharmacists swap drugs without a doctor's say-so? That's not progress-that's negligence. Who's going to be responsible when someone gets a cytokine storm because the batch was made in a different bioreactor in Bangalore? Not the pharmacist. Not the FDA. Definitely not the CEO.

They're calling it 'streamlined.' I call it surrender. We're outsourcing safety to algorithms and cutting corners on human biology. And the worst part? The public doesn't even know. They think 'biosimilar' means 'cheaper generic.' It doesn't. It means 'we hope it works.' And that's terrifying.

They approved 76 biosimilars? Great. How many have actually been used? 28 companies? That's not a market-it's a graveyard of failed startups. The real winners? The ones who bought the patents and sued everyone else into oblivion. The FDA didn't fix the system. They just made it prettier.

And now they're lowering barriers for complex molecules? Antibody-drug conjugates? You think a mass spectrometer can detect subtle glycosylation differences that trigger immune responses? No. It can't. And yet they're waving a magic wand and saying 'it's fine.'

This isn't healthcare reform. It's corporate deregulation with a lab coat.

The new FDA guidance is a big step forward for access. Biosimilars save lives by making treatments affordable. Patients with rheumatoid arthritis and cancer are already benefiting. The data shows they're safe and effective. The science is solid-analytical tools today are far more precise than they were a decade ago. We don't need to test on thousands if we can prove similarity at the molecular level. This isn't cutting corners. It's using better tools.

Interchangeability is about removing unnecessary barriers, not compromising safety. Pharmacists already substitute generics all the time. This is the same principle. Doctors and patients just need clear information. Education matters more than regulation.

Cost savings are real. Hospitals are reporting millions saved. That money can go to more patients, not just corporate profits. The real challenge isn't the science-it's getting providers and payers to trust the data. We're making progress.

Bro the FDA just made biosimilars easier to get and you're acting like it's a conspiracy. Everyone knows generics are cheap but biosimilars are way more complex and now they're not making companies waste 10 years and 300 million just to prove what we already know from the data. You think a mass spec can't detect differences? It can detect a single sugar molecule out of place. The FDA didn't lower standards they just stopped requiring dumb clinical trials when the science says you don't need them. And yes interchangeability should be the default. Why should a pharmacist need a doctor to approve a drug that's already been proven identical? This is 2025 not 2005. Stop being scared of science

So excited about this!! 🙌 Finally the U.S. is catching up to Europe. I work in a clinic and patients are so relieved when they can afford their meds. I've seen so many skip doses because of cost. Biosimilars aren't just cheaper-they're life-changing. The FDA’s new approach is smart, science-based, and long overdue. Let’s keep pushing for more access!! 💪❤️

Did you know the FDA’s new guidance was influenced by a secret lobbying group called 'BioSolutions LLC' that's tied to three of the top five biotech firms? They submitted 87% of the 'public comments' during the draft review period. The 'analytical similarity' standard? It's a backdoor for Big Pharma to lock out smaller players. The mass spectrometers? They're calibrated using proprietary reference standards only the big guys can afford. The FDA's 'Biosimilars Community Resource Center'? It's a PR stunt. They had 12,700 visitors-but only 12 small companies got real help. The rest got brochures.

And the 'interchangeability' push? It's not about science. It's about supply chain control. Once a biosimilar is interchangeable, pharmacies can't switch back to the originator without a new script. That locks in market share. And guess who owns the patents on the reference biologics? The same companies that make the biosimilars. It's not competition-it's consolidation. They're not lowering prices. They're just shifting where the profit goes.

The 23% market share? That's not adoption. That's resistance. Patients and doctors are smart. They know something's off. The FDA says 'trust the data.' But the data is curated. The clinical studies? Mostly done in controlled environments with selected populations. Real-world immunogenicity? Not tracked well. And the post-market surveillance? Underfunded. This isn't progress. It's a quiet takeover.

OMG I JUST READ THIS AND I'M SO EMOTIONAL 😭😭😭 Like I have RA and I switched to a biosimilar last year and my bills dropped from $8k to $4k and I didn't even feel a difference!! But my doctor was like 'are you sure??' and I was like 'BRO I'M FINE' and now I'm telling everyone I know to ask for it!!

Also the FDA is literally heroes!! 🙌 I cried when I heard about interchangeability!! I don't want to wait for a new script every month!!

Also why is everyone so scared?? It's not magic it's science!! 😅

It's funny how we treat biologics like they're some kind of black box. We accept that a generic aspirin is identical because the chemistry is simple. But when it comes to proteins made in living cells, we suddenly need mountains of data. The truth is, biology is messy. Every batch of biologic is slightly different-even the original. The FDA’s new approach just acknowledges that. We're not losing safety. We're just being smarter about how we measure it.

People worry about immune reactions. But if the molecule is structurally identical and the PK profile matches, the risk isn't higher. We've had decades of real-world data on biosimilars in Europe. No surge in adverse events. Just lower costs and better access.

It's not about trusting the FDA. It's about trusting science that's been proven over and over. We don't need to re-prove the same thing every time. We just need to stop letting bureaucracy block progress.

While the FDA’s revised guidance represents a significant evolution in regulatory science, it is imperative to recognize that the underlying principles of biologics manufacturing remain unchanged. The complexity of protein folding, glycosylation patterns, and aggregation propensity necessitates a rigorous, tiered approach to comparability. The reduction in clinical trial requirements is predicated upon the robustness of analytical characterization-not a diminution of standards.

Furthermore, the concept of interchangeability must be approached with caution. While regulatory approval is a necessary condition, it is not sufficient. Clinical adoption requires trust, education, and systemic alignment among prescribers, pharmacists, and patients. Without these, even the most scientifically sound policy may fail to achieve its intended public health outcomes.

The path forward is not merely technical. It is cultural. And that requires more than guidance documents. It requires sustained engagement.

Let’s be real-the FDA didn’t change anything. They just got tired of hearing people complain about how long it takes to approve biosimilars. The whole ‘analytical similarity’ thing? That’s just a fancy way of saying ‘we trust the company’s data because they paid us to.’

Remember when they approved that one biosimilar for Humira and then five people had weird nerve reactions? The FDA said ‘coincidence.’ Then ten more got the same thing. Still ‘coincidence.’ Now they’re saying ‘we don’t need full trials anymore’? Yeah right. Next they’ll say ‘you don’t need to even test the stuff in animals.’

And interchangeability? Please. You think a pharmacist in rural Kansas knows the difference between a biosimilar and a generic? They think ‘biosimilar’ means ‘it’s the same.’ It’s not. It’s ‘kinda similar but we can’t prove it’s safe in every single person.’

And don’t get me started on the patent lawsuits. The big guys just keep filing new patents on tiny tweaks to the original drug. That’s how they block biosimilars for 15 years. And now the FDA is helping them? No thanks.

It’s not progress. It’s surrender.

Let’s not romanticize this. Biosimilars aren’t magic. They’re medicine. And medicine should be accessible. The FDA’s new rules reflect decades of accumulated science-not political pressure. The fact that we can now predict clinical outcomes from molecular data means we’re not guessing anymore. We’re measuring.

Yes, there are risks. But they’re not new risks. They’re the same risks we’ve managed for 20 years with originator biologics. The difference now is that we have better tools to detect them early.

Patients aren’t asking for cheaper drugs because they’re greedy. They’re asking because they’re choosing between rent and insulin. That’s not a policy problem. That’s a moral one.

And yes, doctors need to be educated. But they’re not stupid. They’re just cautious. And that’s okay. We can help them learn. We don’t need to wait for Congress to fix everything. We can start now.

U.S. is still behind europe why are we even talking about this like its a big deal. 23% market share? that's pathetic. we got a whole country of people who think vaccines are microchips and now we're scared of a protein that's 99% the same as the original? fix the culture first. then the FDA can do its job

Oh wow. So now we’re just gonna trust the same companies who priced Humira at $70,000 a year to ‘prove’ their cheaper version is safe? Brilliant. The FDA didn’t lower standards-they just stopped pretending they care about patient safety.

And let’s not forget: every single biosimilar that’s been approved? All made by the same 5 mega-corporations. The ‘small biotechs’? They got a pamphlet and a pat on the head. This isn’t innovation. It’s a monopoly with a new logo.

And the ‘interchangeability’ push? That’s just the final nail. Once pharmacists can swap without permission, the originator drug disappears from shelves. No more negotiation. No more competition. Just a single vendor with a 95% market share.

It’s not science. It’s capitalism with a lab coat.

There’s something poetic about how we treat biologics like sacred artifacts-too complex to replicate, too fragile to trust. Yet we accept that a $50,000 drug is somehow more legitimate than a $30,000 version that does the same thing. We worship the brand, not the biology.

The FDA’s shift isn’t about cutting corners. It’s about rejecting superstition. We don’t need to retest every batch like it’s a ritual. We need to trust the data. And if the data says it’s safe, then let’s stop making patients pay for our fear.

USA is the only country that lets patent trolls delay life-saving drugs for 15 years. FDA’s new rules are just damage control. Real reform? Ban evergreen patents. Let biosimilars enter immediately after patent expiry. No lawsuits. No delays. No ‘interchangeability’ red tape. Just science. Just access. Just justice.

Stop pretending this is about safety. It’s about money. And we’re losing.

Given the nuanced nature of biosimilar approval, I would like to add that the FDA’s decision to waive routine clinical efficacy trials is predicated on a critical assumption: that the reference product’s structure-function relationship is well characterized. This is not universally true. For novel targets or complex modalities, clinical data remains indispensable. The guidance wisely acknowledges this through its three-condition framework.

Moreover, while cost reduction is a laudable outcome, the primary metric of success must remain patient safety and therapeutic equivalence. The FDA’s track record here is strong. The real challenge lies in harmonizing state-level substitution laws with federal approval standards-a logistical, not scientific, barrier.

Let us not mistake regulatory efficiency for regulatory compromise.