Not all generic drugs are created equal. While you might think a generic version of a brand-name medicine is just a cheaper copy, that’s not true for complex generic drugs. These aren’t simple pills with the same active ingredient. They’re advanced formulations-liposomal injections, inhalers with precise dosing, long-acting injectables, or drug-device combos-that require science far beyond what’s needed for a basic tablet. And that’s why they take years longer to get approved, if they get approved at all.

What Makes a Generic Drug "Complex"?

A simple generic, like amoxicillin or metformin, has a small molecule that’s easy to replicate. The FDA can compare it to the brand-name version using standard tests. But complex generics? Their active ingredients are often large molecules-peptides, polymers, or lipids-that behave differently in the body. Even tiny changes in how they’re made can change how they work.

Think of a liposomal injection like bupivacaine. It’s not just the drug in solution. It’s the drug trapped inside microscopic fat bubbles designed to release slowly over days. Replicating that exact structure, size, and release pattern isn’t like copying a recipe-it’s like rebuilding a Swiss watch using different tools. If the liposome is even slightly bigger or the drug leaks out too fast, the whole effect changes. That’s why the first approval of a generic version of this product in 2019 was a big deal. It took years of new testing methods just to prove it worked the same way.

Other examples include inhalers where the device itself matters as much as the drug. A slight difference in the nozzle shape, valve pressure, or aerosol spray pattern can mean patients get less medicine-or too much. The FDA doesn’t just look at the drug. They look at the whole system. And if the generic inhaler doesn’t match the original down to the micron, it gets rejected, even if the active ingredient is identical.

The Approval Process Isn’t Built for This

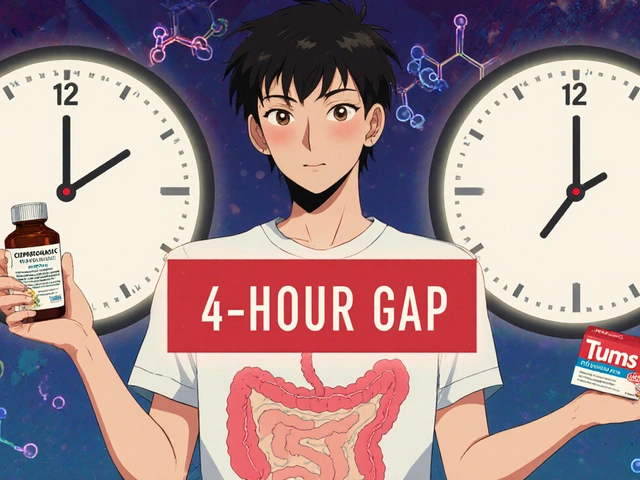

The standard path for generics is the Abbreviated New Drug Application, or ANDA. It’s called "abbreviated" because it doesn’t require new clinical trials. You just prove bioequivalence: your version behaves the same in the body as the brand drug. Simple enough for pills. Impossible for many complex products.

For complex generics, bioequivalence isn’t just about blood levels. You need to prove the drug behaves the same in tissues, releases at the same rate, and interacts with the body in the same way. For a long-acting injectable, that might mean tracking drug levels for weeks, not hours. For an inhaler, it means testing how particles deposit in the lungs. These tests don’t exist in standard labs. Companies have to invent them.

That’s why many developers turn to the 505(b)(2) pathway-a hybrid route meant for modified drugs, not generics. It’s more expensive and slower, but it’s often the only way forward. The FDA didn’t design the ANDA system for this. And for years, the backlog grew. In 2012, the average review time for a generic was over 31 months. Even after reforms under GDUFA II in 2017, progress has been slow.

Why Approval Rates Are So Low

Between 2015 and 2023, the FDA approved over 1,000 conventional generics. During the same period, only about 15 complex generics got the green light. That’s not because no one tried. It’s because most applications fail-not because the drug doesn’t work, but because the data doesn’t meet shifting expectations.

One major problem? Lack of clear guidance. The FDA has published over 1,700 Product-Specific Guidelines (PSGs) to help developers, and more than 200 new ones came out in 2022-2023 alone. But for many complex products, no PSG exists. Companies spend millions developing a product, only to find out the FDA expected something different. One expert put it bluntly: "Without specific guidance, FDA’s expectations are unclear and appear to be continuously evolving."

Even when guidance exists, testing is expensive. A conventional generic might cost $5-10 million to develop. A complex one? $20-50 million. And it takes 5-7 years-not 2-3. That’s a huge risk for companies, especially smaller ones. Many just walk away.

Global Differences Make It Worse

The FDA isn’t the only hurdle. In China, the National Medical Products Administration (NMPA) often requires local clinical trials and a local legal agent. In Brazil, ANVISA demands certification of every lab and clinical site under ICH guidelines. Even if a company gets FDA approval, they can’t just sell the same product overseas. They have to re-do half the work.

This fragmentation means complex generics rarely reach global markets. Patients in the U.S. might get access years before patients in Europe or Asia-even if the drug was developed in the same lab.

Who’s Getting Left Behind?

The biggest problem isn’t just slow approvals. It’s who’s affected. Many complex generics target chronic conditions-cancer, pain, asthma, diabetes-that need long-term, precise dosing. Patients on these drugs often can’t switch easily. If a cheaper version doesn’t come to market, they’re stuck paying hundreds or thousands of dollars a month.

And here’s the irony: the FDA approves more generics every year, but most are "fourth or fifth generation" versions of old drugs. That means more competition for drugs that already have low prices. Meanwhile, the complex ones-where real savings could be huge-stay off shelves.

Health Affairs pointed out in 2021 that the FDA doesn’t track which drugs patients actually need most. There’s no formal system to say: "This liposomal drug is in short supply. Let’s prioritize its generic." Patient input is rare. Advisory councils exist, but they rarely shape approval priorities.

What’s Changing? And What’s Not

The FDA knows the problem. They’ve hired 128 new staff for generic review since 2023. They’ve expanded their Pre-ANDA meeting program-over 1,200 meetings held by 2023-to help companies avoid dead ends. They’re investing in new science: machine learning to predict bioequivalence, AI to analyze complex data, and quality-by-design frameworks that build consistency into manufacturing from day one.

Industry experts believe AI could cut development time by 20-30% by 2027. Quality-by-design could reduce review cycles by nearly half for well-characterized products. But these are long-term fixes. The pipeline is still thin.

By 2028, complex generics could make up 25% of the $250 billion global generics market. That’s because branded drugs worth $75 billion a year are losing patent protection. But unless the approval process catches up, most of that money will still go to brand-name makers.

It’s Not Just About Science. It’s About Will

Complex generics aren’t hard to approve because we lack the science. We have the tools. We have the data. We have the experts.

What’s missing is a system that treats these products as urgent-not just technically challenging. The FDA has made progress. But progress isn’t enough. Patients waiting for affordable pain relief, asthma control, or cancer treatment can’t afford to wait five more years for a generic that’s scientifically possible but bureaucratically stuck.

The real question isn’t whether we can approve these drugs. It’s whether we’re willing to make the system fast enough to matter.

It’s wild how we treat complex generics like they’re some kind of magic trick instead of advanced medicine. I’ve seen patients on liposomal chemo who can’t switch because the generic isn’t approved, and they’re bleeding money every month. The science is there - it’s the bureaucracy that’s broken.

And don’t get me started on how the FDA keeps changing the goalposts. Companies spend millions only to be told, ‘We didn’t expect that particle size.’ That’s not regulation - that’s guesswork with a badge.

Typical US overregulation. In Australia, we just approve the damn thing if it’s chemically identical and move on. Why do we need AI and machine learning to test if a pill works? It’s not rocket science. Stop overcomplicating everything and let the market decide.

Also, why is the FDA the global pharmacy police? Get your own house in order before telling India and Brazil how to run their systems.

The systemic failure here isn’t technical - it’s moral. We have the tools to make these drugs accessible. We have the data. We have the scientists. But we choose not to prioritize patients who need them most.

Complex generics aren’t luxury items. They’re lifelines for people with chronic pain, asthma, and cancer. The fact that we treat them like R&D experiments instead of public health necessities is a failure of leadership - not science.

And no, ‘progress’ doesn’t cut it when someone’s skipping doses because they can’t afford the brand. This isn’t about efficiency. It’s about justice.

Let’s be honest: the entire generic drug approval system was designed for aspirin, not liposomal nanotechnology. We’re trying to fit a quantum computer into a 1980s floppy disk drive.

And yet, somehow, we still expect companies to follow a 40-year-old regulatory framework written before the internet existed. It’s not that the FDA is slow - it’s that we’re asking them to solve problems with tools that were retired decades ago.

Meanwhile, the pharmaceutical industry keeps lobbying to protect brand monopolies under the guise of ‘safety.’ Funny how ‘safety’ always lines up with profit margins.

Have you ever considered that the FDA’s reluctance may not be bureaucratic incompetence - but rather a deliberate strategy to protect the pharmaceutical oligarchy? The same conglomerates that fund congressional campaigns also profit from the status quo.

AI? Quality-by-design? These are shiny distractions. The real issue: 92% of FDA advisory committee members have financial ties to brand-name manufacturers. Coincidence? I think not.

And let’s not forget - every time a complex generic is rejected, it’s not just a delay. It’s a death sentence for someone who can’t afford $12,000/month for a liposomal injection.

They call it ‘science.’ I call it systemic murder by regulation.

In India, we make generics for everything - but complex ones? Still tough. We’ve got the labs, we’ve got the people, but without clear FDA guidance, why invest $50M? We’ve seen too many projects die after years of work.

Maybe the FDA needs to sit down with Indian and Chinese regulators. One standard, one set of rules. No more retesting everything for every country. That’s just waste.

People don’t understand how dangerous this is. You think it’s just about money? No. A liposome that leaks too fast isn’t just less effective - it’s toxic. The FDA isn’t being slow; they’re being responsible. You want cheap drugs? Fine. But don’t pretend that cutting corners saves lives when it might kill them.

And stop blaming the regulators. The companies are the ones who can’t even replicate what the original manufacturers built. That’s not a policy problem - that’s a failure of engineering.

Imagine if we treated car safety like we treat complex generics. ‘Hey, this new brake system works the same as the old one - just slightly different materials. Let’s skip the crash tests because it’s cheaper.’

We wouldn’t. So why do we do it with drugs that go inside people? The FDA’s caution isn’t red tape - it’s a lifeline. The problem isn’t the regulators. It’s that we’ve built a system where profit outweighs patient outcomes.

And yeah, AI will help. But only if we stop treating this like a spreadsheet and start treating it like a human crisis.