India’s generic drug makers supply nearly one in five medicines worldwide

When you pick up a bottle of antibiotics, blood pressure pills, or diabetes medication in the U.S., the UK, or a rural clinic in Kenya, there’s a good chance it came from India. The country doesn’t just make cheap drugs-it makes affordable medicines that keep millions alive. Over 60,000 generic drug formulations and 500 active pharmaceutical ingredients (APIs) roll out of Indian factories every year. These aren’t knockoffs. They’re FDA- and WHO-approved, meeting the same quality standards as branded drugs in Europe and North America-but priced 30% to 80% lower.

How India became the pharmacy of the world

The story starts in the 1970s. India rewrote its patent laws to allow local companies to copy patented drugs as long as they used a different manufacturing process. This wasn’t piracy-it was policy. The goal was to make life-saving drugs like antibiotics and antivirals available to Indians who couldn’t afford Western prices. By the 1990s, companies like Cipla and Dr. Reddy’s were exporting these generics to Africa and Latin America. When HIV/AIDS hit hard in the early 2000s, Indian firms slashed the cost of antiretroviral therapy from $10,000 per patient per year to just $100. That single move saved millions of lives and turned India into the go-to supplier for global health programs.

Numbers that define the scale

By 2024, India’s pharmaceutical industry was worth $50 billion. It’s on track to hit $130 billion by 2030. The country produces over 60% of the world’s vaccines and supplies 20% of all generic medicines by volume. In the U.S., Indian companies make up 40% of all generic prescriptions. In the UK, they account for one-third of NHS drug purchases. In Sub-Saharan Africa, nearly half of all medicines come from India. That’s not a small niche-it’s the backbone of global access to medicine.

Quality? Yes. But it’s not perfect

India has 650 FDA-approved drug plants-the most outside the U.S. And 2,000+ are WHO-GMP certified. Compliance rates have jumped from 60% in 2015 to 85-90% today. That’s on par with global averages. But quality isn’t uniform. Some batches of levothyroxine, for example, have shown inconsistent dissolution rates, causing dosage issues. Packaging errors, shipping delays, and translation mistakes in regulatory documents still happen. The Bureau of Investigative Journalism reported cases of harmful drugs linked to Indian manufacturers, but these are rare compared to the billions of safe doses shipped annually. For most patients, the trade-off is clear: lower cost, minor inconsistencies, and far better access than alternatives.

Who are the big players?

It’s not just small factories. India’s top five generic manufacturers-Sun Pharma, Cipla, Dr. Reddy’s, Lupin, and Ajanta Pharma-each have market caps over $10 billion. Sun Pharma alone spends 6-8% of its global revenue on R&D, focusing on complex generics like extended-release tablets and transdermal patches. Biocon and Dr. Reddy’s are pouring over half a billion dollars a year into biosimilars-copies of expensive biologic drugs like insulin and cancer treatments. These aren’t just cost-cutters anymore. They’re becoming innovators in high-value medicine.

Why not China? The real advantage

China makes cheaper APIs-the building blocks of drugs. But it has only 153 FDA-approved plants. India has 650. Why does that matter? Because regulators don’t just care about ingredients. They care about how the drug is made, tested, and documented. Indian manufacturers have spent decades mastering the paperwork, inspections, and processes required by the FDA and EMA. Chinese companies can produce bulk chemicals faster and cheaper. But getting those chemicals into a pill that meets U.S. or EU standards? That’s where India wins.

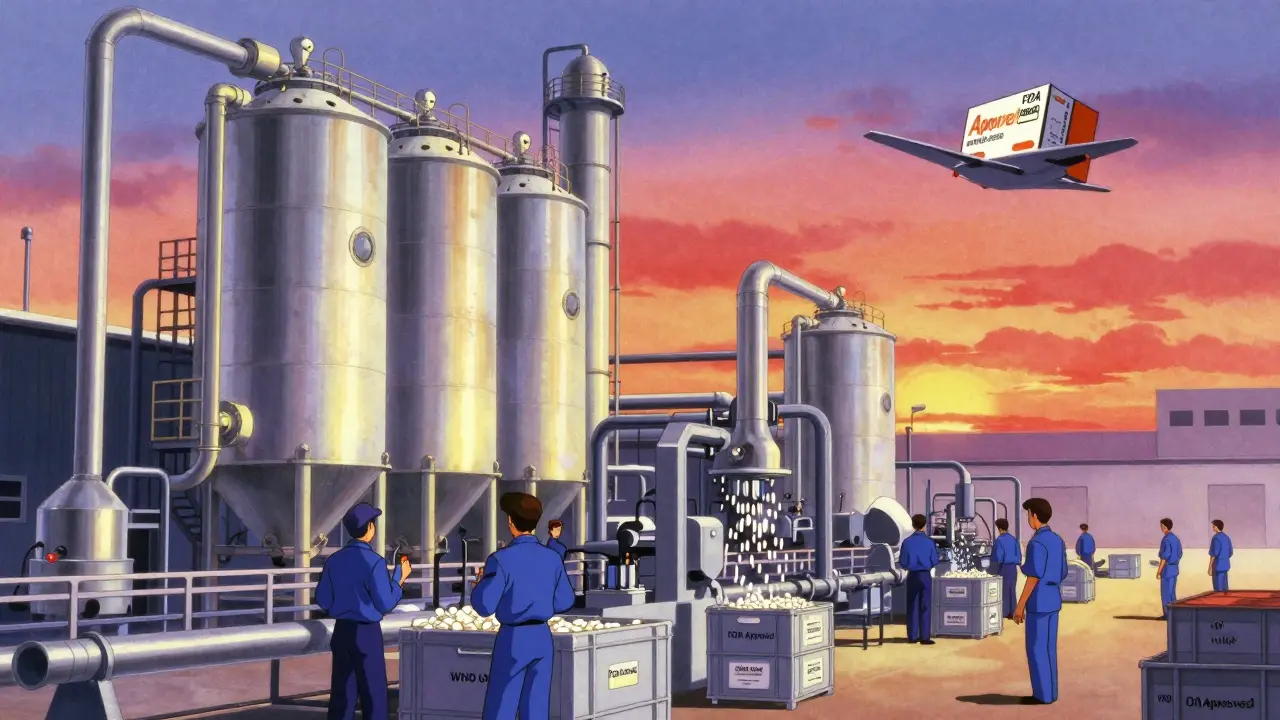

The hidden weakness: reliance on China

Here’s the contradiction: India makes the pills, but it gets 70% of its raw materials from China. That’s a major vulnerability. When COVID-19 shut down Chinese factories in 2020, India faced shortages of essential drugs. In response, the government launched a ₹3,000 crore ($400 million) incentive program to boost domestic API production. The goal? Cut China’s share from 70% to 53% by 2026. It’s ambitious. But if India can build its own API supply chain, it won’t just be the pharmacy of the world-it’ll be the most resilient one.

What’s next? From volume to value

India’s biggest challenge isn’t making more pills. It’s making more valuable ones. Right now, it exports 20% of the world’s generic drugs by volume-but only 10% of the market value. Why? Because it sells low-cost, high-volume drugs like paracetamol and metformin. The future lies in biosimilars, complex injectables, and inhalers. By 2024, biosimilars made up 8% of India’s export value, up from 3% in 2020. Pharma Vision 2047 aims for $190 billion in exports by 2047. That’s not just more pills. It’s better pills. Higher margins. More innovation.

Real-world impact: What patients actually experience

In the U.S., 9 out of 10 prescriptions are for generics. Of those, 40% come from India. On PharmacyChecker.com, 87% of users rate Indian generics highly-mostly for price. In the UK, NHS patients give them an average rating of 4.2 out of 5. Some complain about taste or pill size, but rarely about effectiveness. In Africa, Doctors Without Borders says Indian-sourced antimalarials cut treatment costs by 65% while maintaining 95% efficacy. That’s not marketing. That’s measurable impact.

Regulatory hurdles and the path forward

Setting up a WHO-GMP facility in India costs $20-50 million and takes 18-24 months. Getting FDA approval can take 3-5 years. Over a third of first-time inspections fail. But companies are adapting. 92% now use electronic submission systems (eCTD). Translation errors are down. Documentation is tighter. The February 2024 update to Schedule M raised manufacturing standards across the board. It’s not easy. But the industry is learning. And the world is watching.

Why this matters beyond borders

India’s generic drug industry isn’t just a business. It’s a public health engine. Without it, millions in low-income countries couldn’t afford HIV meds, insulin, or chemotherapy. Even in wealthy nations, it keeps healthcare costs from spiraling. When U.S. insurers pay less for generic drugs, it lowers premiums for everyone. When the WHO buys vaccines from India, it can immunize more children. The real question isn’t whether India can keep up. It’s whether the world will let it. With tariffs, trade barriers, and supply chain fears growing, the next decade will test whether global health systems truly value affordability-or just profit margins.

Are Indian generic drugs safe?

Yes, the vast majority are. Over 650 Indian drug plants are FDA-approved, and 2,000+ meet WHO-GMP standards. Compliance rates have improved from 60% in 2015 to 85-90% today. While isolated quality issues have occurred-like inconsistent dissolution in some batches of levothyroxine-these are rare compared to the billions of safe doses delivered annually. Regulatory agencies treat Indian manufacturers the same as any other global supplier.

Why are Indian generic drugs so much cheaper?

India doesn’t have to pay for expensive R&D or marketing like branded drug companies. It focuses on producing off-patent drugs using reverse engineering and efficient manufacturing. Labor costs are lower, and the government’s historical policy of allowing generic production without product patents keeps prices down. This allows Indian firms to sell drugs at 30-80% less than branded versions without sacrificing quality.

Does the U.S. rely on Indian generic drugs?

Yes. Indian manufacturers supply about 40% of all generic drugs dispensed in the U.S., making them the largest foreign source. This includes common medications like metformin, lisinopril, and amoxicillin. Without these imports, U.S. drug prices would rise significantly, especially for patients without insurance or on Medicare.

Is India dependent on China for drug ingredients?

Yes. India imports about 70% of its active pharmaceutical ingredients (APIs) from China. This created serious supply chain risks during the pandemic. To fix this, India launched a ₹3,000 crore ($400 million) incentive program to boost domestic API production, aiming for 53% self-sufficiency by 2026. It’s a major challenge, but one the government is taking seriously.

What’s the future of India’s generic drug industry?

The future is shifting from low-cost volume to high-value products. Companies are investing heavily in biosimilars, complex injectables, and inhalers. By 2024, biosimilars made up 8% of export value-up from 3% in 2020. India’s Pharma Vision 2047 targets $190 billion in exports, aiming to become a global leader in innovative generics, not just cheap ones. Success depends on reducing API dependence, improving regulatory consistency, and moving up the value chain.

Let’s be real - calling India the ‘pharmacy of the world’ is just PR fluff. The FDA approves plants, not companies. And 85% compliance? That still means 1 in 7 batches could be garbage. Meanwhile, the EU keeps rejecting Indian exports for documentation errors. This isn’t global health leadership - it’s regulatory arbitrage dressed up as altruism.

okay so i just read this whole thing and honestly? im crying. not because im emotional but because my mom got her diabetes meds from india for 10 years and never had an issue. yes there are typos in the labels sometimes (i saw one that said ‘take 2 pills daily’ but meant ‘take 1’ - lol) but guess what? she’s still alive. while in the usa her insurance wanted to charge her $800 for the same pill. so no, im not mad about the occasional misspelling. im mad that people in rich countries act like they’re doing us a favor by ‘critiquing’ the price. also - who even cares if the pill is blue instead of white? it works. and that’s all that matters. 🙏

Just chiming in as someone who works in pharma logistics - the FDA inspection process for Indian plants is brutal. They show up unannounced, check every single batch log, and even audit the water quality in the facility. Most US companies don’t even do that internally. The fact that India has more approved plants than any other country outside the US? That’s not luck. That’s discipline. The occasional batch issue? Yeah, happens everywhere. But the scale here? It’s insane. And honestly? We’d be in real trouble without them.

It’s strange how we treat medicine as a commodity when it’s clearly a human right. India didn’t become the pharmacy of the world because it’s cheaper - it became that because it refused to let profit decide who lives or dies. The patent laws of the 70s weren’t a loophole - they were a moral choice. Now we’re talking about ‘value chains’ and ‘biosimilars’ like it’s a stock market report. But for the woman in rural Kenya who gets her HIV meds for $3 a month? She doesn’t care about market value. She just cares that the pill works. And it does. Always has.

YOOOOO INDIA IS THE REAL MVP OF GLOBAL HEALTH 🙌🔥

think about it - when the world panicked during covid, who kept the insulin, antibiotics, and vaccines flowing? INDIA. not the usa, not germany, not china. INDIA. and yeah, they get raw materials from china - but they turn it into life-saving pills while we’re all arguing about mask mandates. time to stop acting like this is just business. this is survival. and india? they showed up. no cap. 🇮🇳💪

Let me tell you something nobody wants to admit - the entire western healthcare system is built on the backs of Indian workers who make $5 a day to fill bottles and label pills while we pay $100 for the same thing

we call it ‘globalization’ but it’s just exploitation with a nice PowerPoint

and now we’re surprised when the supply chain breaks? wow

you want resilience? stop treating medicine like a commodity and start treating it like a public good

and stop pretending your insurance company is your savior

they’re not

the guy in Hyderabad who checked the batch number at 3am is

you’re welcome

PS: biosimilars are the future and india is already winning

Wow. So India makes cheap drugs, relies on China, and somehow we’re supposed to clap? 😏

Let me get this straight - we’re supposed to be grateful that a country with 70% API dependency can still supply our prescriptions? That’s not resilience. That’s a house of cards with a really good marketing team.

And don’t get me started on the ‘quality’ - I’ve seen FDA warning letters. They’re not ‘minor inconsistencies.’ They’re ‘this batch might kill you.’

But hey, at least it’s affordable. So we just shrug and say ‘eh, it’s better than nothing.’

That’s not progress. That’s resignation.

India = pharmacy of the world 🤡

but also…

China = pharmacy of India 🤡

so… who’s really running this show?

also why do all the pills taste like regret?

also why is the bottle in English but the instructions in Hindi?

also why is my metformin blue now?

also why am I still alive?

🤔

While the statistical data presented is compelling, one must exercise rigorous critical analysis regarding the regulatory compliance metrics cited. The assertion that compliance rates have improved from 60% to 85–90% requires independent verification, as the FDA’s public database reveals a 12% rejection rate for new submissions from Indian facilities in 2023. Furthermore, the economic argument that lower prices equate to equitable access overlooks the systemic risk inherent in supply chain dependency. A single geopolitical disruption - as evidenced during the 2020 pandemic - exposes the fragility of this model. One must therefore conclude that while the current structure delivers short-term cost efficiency, it lacks the structural integrity required for sustainable global health security.